| Sector | Operating margin range |

| Engineering | 10% to 20% |

| Cement | 13% to 33% |

| Retail* | 7% to 11% |

| Pharma | 10% to 24% |

| FMCG$ | 13% to 15% |

| IT | 26% to 30% |

| Telecom | 27% to 37% |

| Hotels | 18% to 40% |

| Power | 15% to 20% |

| Automobiles# | 8% to 16% |

| Steel^ | 9% to 28% |

| Construction | 12% to 23% |

Thursday, July 9, 2009

Operating margin across sectors

Wednesday, July 8, 2009

Tuesday, January 6, 2009

Markets goind ahead and Suzlon

Stock markets yesterday have crossed the key resistance levels of 3100.Every move from here would be a cautious move as there would be sellers at higher levels of 3150,3200 and 3250.

Fundamentally things are looking good with the inflation coming down sharply and interest rates falling down.Government has reduced the CRR ,repo and reverse repo.Banks are still not lending but this move forces banks to lend money as the interest rates of parking money with RBI is very less at 4%.

Things may not be looking good for the interest rate sensitive sectors right now,but this would be the time to invest in these sectors.With the rates falling the demand would slowly start coming back into these sectors.One can expect a very good returns of 50% in 3 to 6 month perspective.

Suzlon has sold 10% of its stake in hansen to finance its REPower acquisition.This is a positive move.As the debt to equity ratio of suzlon is around 1:1,more leverage would have been negative to Suzlon.This money is not sufficient for the acquistion but they are in a right direction.REPower acquisition is very important to Suzlon as REpower is the largest wind turbin maker in Germany,in the country which has highest wind energy production.RePower has excellent technology and brand name which would help Suzlon to build the confidence which it lost due to the broken blades.If Suzlon as planned completes its acuquisition of REPower on schedule there can be heavy buy in this stock which would move the stock easily to 90 to 120.

Fundamentally things are looking good with the inflation coming down sharply and interest rates falling down.Government has reduced the CRR ,repo and reverse repo.Banks are still not lending but this move forces banks to lend money as the interest rates of parking money with RBI is very less at 4%.

Things may not be looking good for the interest rate sensitive sectors right now,but this would be the time to invest in these sectors.With the rates falling the demand would slowly start coming back into these sectors.One can expect a very good returns of 50% in 3 to 6 month perspective.

Suzlon has sold 10% of its stake in hansen to finance its REPower acquisition.This is a positive move.As the debt to equity ratio of suzlon is around 1:1,more leverage would have been negative to Suzlon.This money is not sufficient for the acquistion but they are in a right direction.REPower acquisition is very important to Suzlon as REpower is the largest wind turbin maker in Germany,in the country which has highest wind energy production.RePower has excellent technology and brand name which would help Suzlon to build the confidence which it lost due to the broken blades.If Suzlon as planned completes its acuquisition of REPower on schedule there can be heavy buy in this stock which would move the stock easily to 90 to 120.

Tuesday, December 16, 2008

Indian markets and you

Market is gaining strength with good buying coming in from the FII and DII.Has the market bottomed out?.Are these the lower levels for the market.Is there any bad news coming in to take the market lower.Not sure about all that but it looks like there is lot of value buying coming in at the lower levels.

The next set of news can be seen in terms of the quarterly results.Which are expected to be worse.It has to be seen if the market has already factored in those results or will the results be much worse pulling the market down.Q4 results are expected to be lower but might be better than Q3 as the huge fall of commodities would reflect more in the Q4 results which would increase the margins of the companies overcoming the sales.So it can be expected that the market has already found its bottom or may find its bottom when the Q3 results come out.

Apart from the market it is very funny to see how the mood of everyone changes with the market.When the market is going down,it all seems as if the we would loose all our money and is better to get out by selling atleast at breakeven.When the market is going up,we feel oh my god why didn't I buy at lower level,why did I have the fear at that levels.

I guess one has to be very specific in markets by defining themselves what they are.If they want the returns immediately then they are traders and they would be looking for returns within a day to a week.Hence they should be looking for news which might come out in that week and hence decide how the market would react for them.If one is medium term of 2 to 4 months then one has to think in the same terms and should not react for daily news and swings in the market.

The next set of news can be seen in terms of the quarterly results.Which are expected to be worse.It has to be seen if the market has already factored in those results or will the results be much worse pulling the market down.Q4 results are expected to be lower but might be better than Q3 as the huge fall of commodities would reflect more in the Q4 results which would increase the margins of the companies overcoming the sales.So it can be expected that the market has already found its bottom or may find its bottom when the Q3 results come out.

Apart from the market it is very funny to see how the mood of everyone changes with the market.When the market is going down,it all seems as if the we would loose all our money and is better to get out by selling atleast at breakeven.When the market is going up,we feel oh my god why didn't I buy at lower level,why did I have the fear at that levels.

I guess one has to be very specific in markets by defining themselves what they are.If they want the returns immediately then they are traders and they would be looking for returns within a day to a week.Hence they should be looking for news which might come out in that week and hence decide how the market would react for them.If one is medium term of 2 to 4 months then one has to think in the same terms and should not react for daily news and swings in the market.

Friday, December 12, 2008

How will the week end

Markets on Thursday ended flat coming off the lows of the day.There was a support for the market at the lower levels indicating some strength against the selling pressure seen earlier in the day.

Government has hinted on Thursday that it will declaring a second stimulus package next week targeting mainly at the export market to lift the employment in the textile industry and other export oriented companies.Package may also support Agricultural sector as the inflation of food articles is still on a rise as all other commodities fall and push the overall inflation down.

MTNL has started India's first 3G service yesterday in Delhi.BSNL will be coming out in mid of January.3G in India is just in a starting phase.Today there will be a guidelines for 3G aution which may happen by end of Jan.Its the next big development in the India Mobile industry.All mobile operators are getting ready for the aution by selling part of there stakes to foreign telcos thereby generating enough funds to finance the aution.With only 2-4 licences available for private operators in each circle it has to be seen till what extent these companies would stretch themselves in the aution.

Telcos have to wait for a long time for the returns to be gererated out of the 3G.With 90% of the indian Mobile operators being the middle and lower middle class it is very unlikely that they would upgrade to 3G.In the intial years 3G would be mainly used only by the corporate sector.The next segment of users might be the younger employed generation.

Government has hinted on Thursday that it will declaring a second stimulus package next week targeting mainly at the export market to lift the employment in the textile industry and other export oriented companies.Package may also support Agricultural sector as the inflation of food articles is still on a rise as all other commodities fall and push the overall inflation down.

MTNL has started India's first 3G service yesterday in Delhi.BSNL will be coming out in mid of January.3G in India is just in a starting phase.Today there will be a guidelines for 3G aution which may happen by end of Jan.Its the next big development in the India Mobile industry.All mobile operators are getting ready for the aution by selling part of there stakes to foreign telcos thereby generating enough funds to finance the aution.With only 2-4 licences available for private operators in each circle it has to be seen till what extent these companies would stretch themselves in the aution.

Telcos have to wait for a long time for the returns to be gererated out of the 3G.With 90% of the indian Mobile operators being the middle and lower middle class it is very unlikely that they would upgrade to 3G.In the intial years 3G would be mainly used only by the corporate sector.The next segment of users might be the younger employed generation.

Thursday, December 11, 2008

Was a big day

It was a very good day on Wednesday for the markets posting a very good gains of 5%.It was only on Wednesday that markets have reacted strongly to the news which came out over weekend.

With US markets ending up marginally up by 1% and Asian markets being slightly negative ,Indian markets might find themselves slightly up as the mood might be still bullish on account of market breaking the key technical levels on Wednesday.With Inflation data to be out today,which may only bring good or very good news.

Auto sector is certainly seems to be very bad with Mahindra shutting down the Logan plant for about 3 months atleast .There have been drastic cut in the prices across all segments in the auto sector but the hopes of demand improving is not looking good.

RBI has officialy declared that growth for India is on slowdown and actual growth might come out lower then what they were expecting it to be.This news has been making rounds but its only now that govt has come out officially.This will effect the foreign inflows to the country.Relatively growth in India is higher when compared to growth Globally.But it has to be seen how FII's would see it.

Public sector banks have started reacting the RBI's move of moving home loans below 20 lakhs to priority sector loans.Banks have started to reduce home loan rates by 2% for home loans below 20 lakhs and 3% for loans below 5 lakhs.This a good news for propective home loan owners as 80% of home loans fall under this category.But still people may find themselves on waiting side as interest rates may further come down in coming 6 months.But the end of the day it is a good news and may push some people to get ahead and purchase.

With US markets ending up marginally up by 1% and Asian markets being slightly negative ,Indian markets might find themselves slightly up as the mood might be still bullish on account of market breaking the key technical levels on Wednesday.With Inflation data to be out today,which may only bring good or very good news.

Auto sector is certainly seems to be very bad with Mahindra shutting down the Logan plant for about 3 months atleast .There have been drastic cut in the prices across all segments in the auto sector but the hopes of demand improving is not looking good.

RBI has officialy declared that growth for India is on slowdown and actual growth might come out lower then what they were expecting it to be.This news has been making rounds but its only now that govt has come out officially.This will effect the foreign inflows to the country.Relatively growth in India is higher when compared to growth Globally.But it has to be seen how FII's would see it.

Public sector banks have started reacting the RBI's move of moving home loans below 20 lakhs to priority sector loans.Banks have started to reduce home loan rates by 2% for home loans below 20 lakhs and 3% for loans below 5 lakhs.This a good news for propective home loan owners as 80% of home loans fall under this category.But still people may find themselves on waiting side as interest rates may further come down in coming 6 months.But the end of the day it is a good news and may push some people to get ahead and purchase.

Tuesday, December 9, 2008

Will the rally go on

Markets have ended positive on Monday in reaction to the Govt's monetary and fiscal action.But markets were off days high indicating some weakness.

There is a impression in the market that the stimulus provided by Govt is not enough to boost the economy.A further cut in CRR and SLR is needed.Which might only be declared once the inflation is seen cooling down.Stimulus declared by India is very nominal considering the $580 billion package by Chinese govt and drastic cuts by European banks.

The excise duty cut is a positive sign for the auto sector,helping the companies to slash prices by 2 to 4%.Cooling down interest rates also adds to the hopes auto sector which is seeing a huge slowdown.

With no major news in line Indian markets can be seen in line with global markets.Going ahead markets would start aligning itself to the results which would start coming out in early Jan.

There is a impression in the market that the stimulus provided by Govt is not enough to boost the economy.A further cut in CRR and SLR is needed.Which might only be declared once the inflation is seen cooling down.Stimulus declared by India is very nominal considering the $580 billion package by Chinese govt and drastic cuts by European banks.

The excise duty cut is a positive sign for the auto sector,helping the companies to slash prices by 2 to 4%.Cooling down interest rates also adds to the hopes auto sector which is seeing a huge slowdown.

With no major news in line Indian markets can be seen in line with global markets.Going ahead markets would start aligning itself to the results which would start coming out in early Jan.

Saturday, December 6, 2008

Will petrol price and CRR cut help

Long awaited petrol price and CRR cut has been declared.But they were expected.Govt has not slashed the rates more than what the market has been expecting.So its almost sure that there may not be a rally on Monday morning reacting to these steps by government.

With inflation already coming down and seen at 8.2% this week,it can cool down to still lower levels once the impact of reduced petrol is felt.That will give flexibility for the government to reduce the interest rates further.With elections in few months ,government would try max to please the public by reducing the petrol prices and interest rates further.

But effects of all these cuts would not be seen immediate.It would take time for CRR cut to be reflected in the banks liquidity and then the business.The exact time frame may not be guessed but it might be around two quarters.Till which we would see all the companies facing tight liquidity problem and hence would end up reporting poor and poorer results for the coming months.

With inflation already coming down and seen at 8.2% this week,it can cool down to still lower levels once the impact of reduced petrol is felt.That will give flexibility for the government to reduce the interest rates further.With elections in few months ,government would try max to please the public by reducing the petrol prices and interest rates further.

But effects of all these cuts would not be seen immediate.It would take time for CRR cut to be reflected in the banks liquidity and then the business.The exact time frame may not be guessed but it might be around two quarters.Till which we would see all the companies facing tight liquidity problem and hence would end up reporting poor and poorer results for the coming months.

Tuesday, October 21, 2008

Sector investing

Sector indicates a group of companies doing similar business. These sectors fall into two categories Cyclical and non-cyclical.

Non-cyclical sectors are the ones which do well irrespective of the prevailing economic condition like the Food ,Health care and daily needs ... . People will not stop using them even if the economy is in downturn.

Cyclical sectors do well when there are favorable conditions for them.Like the real estate sector does well when the interest rates are lower similarly cement and auto sector.As a result earnings of these companies are very good pushing the stock prices up.Hence before investing it is very important for one to consider the economic conditions in which the sector is in.

Following are the Cyclical sectors.

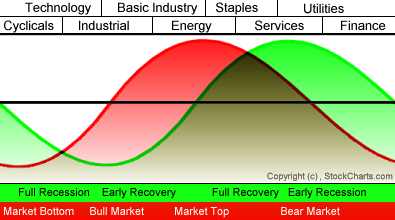

To understand the above graph one needs to know the different phases a economy can be in.

Full Recession -- Interest rates are high , cost of borrowing funds is high as a result no any expansions are planned.Customer spending is low as a result companies produce less goods,more news about layoffs.

Early recovery -- Interest rates start to ease a bit,customer spending slowly picks up as a result companies start increasing the production as a result they need more staff as a result the jobless claims reduce.

Full recovery -- Whole economy is doing great ,interest rates are lower.Customer spending increases a lot as a result companies start the expansion plans.

Early recession -- Inflation has peeked up so the Government increases the interest rate making money tighter to get. Customers find everything costly ,thereby reducing the spending,expansion plans of the companies comes to a halt.

Stock market is always 3 to 6 months ahead of the market.You might find a company declaring great results for the present quarter but you find that the stock price of the company is indeed falling drastically.Reason for this fall is that stock market is considering that though the company has come out with great results the future of the company is not looking great and it forecasts that the company would not come out with great results in coming quarters.

Non-cyclical sectors are the ones which do well irrespective of the prevailing economic condition like the Food ,Health care and daily needs ... . People will not stop using them even if the economy is in downturn.

Cyclical sectors do well when there are favorable conditions for them.Like the real estate sector does well when the interest rates are lower similarly cement and auto sector.As a result earnings of these companies are very good pushing the stock prices up.Hence before investing it is very important for one to consider the economic conditions in which the sector is in.

Following are the Cyclical sectors.

The graph below, courtesy of StockCharts.com , shows these relationships and the order the key sectors respond to the economic cycle. The Stock Market Cycle precedes the Economic Cycle as investors try to anticipate how the market will react to the changes to the economy.

Sector Rotation Model:

To understand the above graph one needs to know the different phases a economy can be in.

Full Recession -- Interest rates are high , cost of borrowing funds is high as a result no any expansions are planned.Customer spending is low as a result companies produce less goods,more news about layoffs.

Early recovery -- Interest rates start to ease a bit,customer spending slowly picks up as a result companies start increasing the production as a result they need more staff as a result the jobless claims reduce.

Full recovery -- Whole economy is doing great ,interest rates are lower.Customer spending increases a lot as a result companies start the expansion plans.

Early recession -- Inflation has peeked up so the Government increases the interest rate making money tighter to get. Customers find everything costly ,thereby reducing the spending,expansion plans of the companies comes to a halt.

Stock market is always 3 to 6 months ahead of the market.You might find a company declaring great results for the present quarter but you find that the stock price of the company is indeed falling drastically.Reason for this fall is that stock market is considering that though the company has come out with great results the future of the company is not looking great and it forecasts that the company would not come out with great results in coming quarters.

Monday, October 13, 2008

Why following a mutual fund portfolio is a bad idea.

Individual investor does not have all the access to the data which mutual funds have.So he might think it is a better idea to follow the portfolio of a mutual fund and there by get returns which are equal or more than the mutual fund returns.

But this strategy has more pitfalls then gains.Lets see what are the reasons for this.

1.Wider diversification.

Mutual funds have a diversified portfolio having around 30 to 50 stocks.Out of which some stocks may do good while others may fail.On average resulting positive returns to the fund.

Individual investor who tries to mimic the portfolio of a mutual fund , may not have the ability to maintain a diversified portfolio,who instead would choose only fewer stocks from the mutual fund portfolio.

To his bad luck if these are the stocks which have not done well ,then investor has to end up taking loses.

2.Incomplete information on portfolio.

Mutual funds shuffle their portfolio and it is not possible to gather information about the when they are changing the portfolio.They might be knowing a insider story and might sell a stock immediately knowing a bad news is in line.

Individual investor might find himself late catching the falling knife.By the time he knows the action taken by the mutual fund ,damage would have been done.

Hence it not a profitable idea always to mimic a portfolio of a mutual fund.Hence an individual investor can use the mutual fund information to find which stocks are hot and not among the mutual funds and can make a investment decision.

But this strategy has more pitfalls then gains.Lets see what are the reasons for this.

1.Wider diversification.

Mutual funds have a diversified portfolio having around 30 to 50 stocks.Out of which some stocks may do good while others may fail.On average resulting positive returns to the fund.

Individual investor who tries to mimic the portfolio of a mutual fund , may not have the ability to maintain a diversified portfolio,who instead would choose only fewer stocks from the mutual fund portfolio.

To his bad luck if these are the stocks which have not done well ,then investor has to end up taking loses.

2.Incomplete information on portfolio.

Mutual funds shuffle their portfolio and it is not possible to gather information about the when they are changing the portfolio.They might be knowing a insider story and might sell a stock immediately knowing a bad news is in line.

Individual investor might find himself late catching the falling knife.By the time he knows the action taken by the mutual fund ,damage would have been done.

Hence it not a profitable idea always to mimic a portfolio of a mutual fund.Hence an individual investor can use the mutual fund information to find which stocks are hot and not among the mutual funds and can make a investment decision.

Subscribe to:

Posts (Atom)