Non-cyclical sectors are the ones which do well irrespective of the prevailing economic condition like the Food ,Health care and daily needs ... . People will not stop using them even if the economy is in downturn.

Cyclical sectors do well when there are favorable conditions for them.Like the real estate sector does well when the interest rates are lower similarly cement and auto sector.As a result earnings of these companies are very good pushing the stock prices up.Hence before investing it is very important for one to consider the economic conditions in which the sector is in.

Following are the Cyclical sectors.

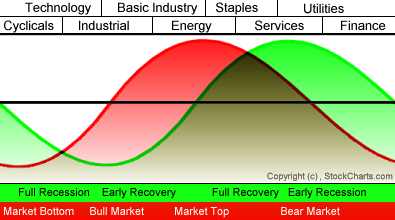

The graph below, courtesy of StockCharts.com , shows these relationships and the order the key sectors respond to the economic cycle. The Stock Market Cycle precedes the Economic Cycle as investors try to anticipate how the market will react to the changes to the economy.

Sector Rotation Model:

To understand the above graph one needs to know the different phases a economy can be in.

Full Recession -- Interest rates are high , cost of borrowing funds is high as a result no any expansions are planned.Customer spending is low as a result companies produce less goods,more news about layoffs.

Early recovery -- Interest rates start to ease a bit,customer spending slowly picks up as a result companies start increasing the production as a result they need more staff as a result the jobless claims reduce.

Full recovery -- Whole economy is doing great ,interest rates are lower.Customer spending increases a lot as a result companies start the expansion plans.

Early recession -- Inflation has peeked up so the Government increases the interest rate making money tighter to get. Customers find everything costly ,thereby reducing the spending,expansion plans of the companies comes to a halt.

Stock market is always 3 to 6 months ahead of the market.You might find a company declaring great results for the present quarter but you find that the stock price of the company is indeed falling drastically.Reason for this fall is that stock market is considering that though the company has come out with great results the future of the company is not looking great and it forecasts that the company would not come out with great results in coming quarters.

No comments:

Post a Comment